Blended finance offers the key to unlock transformational finance to climate-proof Latin America’s agricultural sector

Climate finance is stuck.

The sustainable transition, particularly in agriculture, is being held back by a lack of catalytic risk capital from concessional finance providers. By making transition projects more investable, these providers can crowd in much–needed private sector finance.

According to the World Economic Forum, just 20% of climate finance comes from the private sector.

To unstick finance and activate it at scale and pace, we must advance blended finance models and transform how concessional and private finance organisations collaborate.

Only then will climate finance flow to the countries and sectors that need it most—such as agriculture and cattle ranching in Latin America, a strategically important economy for the region and a huge contributor to greenhouse gases.

Two words underpin the finance gridlock: perceived risk. Investments can be highly complex—particularly when centring on new business models, sectors or approaches—but lenders must be flexible and adaptive.

The issue isn’t the lack of money; there is money available. But both public and private finance have diverse requirements that inhibit rapid mobilisation and deployment at scale.

Without this change, lending will continue to flow to the least risky areas—not where investment is critically needed.

In the context of climate finance, the perceived risks are amplified and felt even more acutely by developing countries.

According to OECD, Latin America has a $99 billion sustainable financing gap. Plus, a mere 1–2% of finance dedicated to agriculture is received by the sustainable livestock sector in the region, even though it represents 60% of agricultural emissions.

This is in the context of increasing record-breaking climate impacts. Fire alerts in the Amazon Rainforest were 79% higher in 2024 than in 2023. High temperatures, driven by the El Niño weather cycle, have led to record rainfall, with flash flooding devastating lives and crops across the region.

Bottom–up change is not easy, though, and landowners often struggle to access the technical and financial assistance needed for a sustainable transition. Up-front costs are a barrier to action, and private sector banks can be averse to providing loans to farms due to repayment concerns.

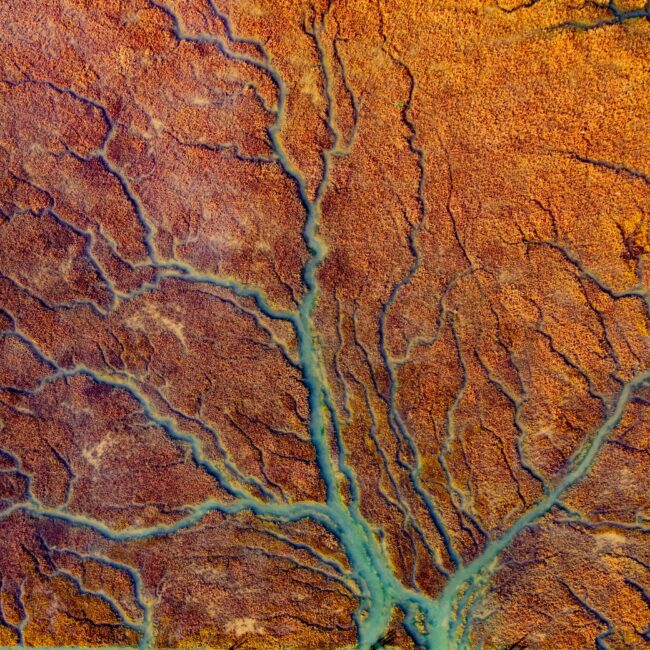

Carbono Rural – Paraguay

This is where blended finance models come in. Bringing together stakeholders from across the financing system, they layer respective funding streams, counter the siloed nature of current mechanisms, and make the money “work” harder.

Reports suggest that up to $15 billion USD in concessional funds could generate over $280 billion USD in private investment.

The task is daunting: Creating a profitable farming mechanism that generates revenue while working towards reducing impact on the planet.

Blended finance approaches can de-risk the entire farming venture while ensuring it is profitable, legitimate, and delivering on decarbonisation and climate-resilient methods.

How blended finance works in practice can take many forms, but I see three main priorities when developing the models: Technical assistance, effectively facilitating finance flows, and guaranteeing end-buyer interest.

Technical assistance

Landowners need support to know where to begin with implementing new cutting-edge techniques. This is where sustainable land use experts and agro–economists come in.

They can deliver the technical training and ongoing support needed to implement climate-friendly farming techniques and utilise the various available financing streams. In turn, this technical assistance provides reassurance to commercial lenders that the green transition is being done properly.

Enabling the flow of finance

The blended finance mechanism at its core aims to optimise and de-risk capital. It must therefore have an established process for facilitating the flow of multiple sources of public finance, in order to mobilise private capital at scale.

For example, it might direct investment from philanthropic organisations into the technical assistance programmes, or even provide guarantees to private sector agri-banks that might be looking to directly finance the farm’s sustainable transition.

End-buyer commitment

The mechanism should be built on transparent funding, and robust technical, systems that reduce perceived and real investment risks in emerging markets – thereby attracting greater end-buyer interest and guaranteeing longer-term investment.

When investors commit to upfront investment through offtake agreements, encouraged by landowners implementing the practices gained from the technical assistance, it supports a positive, self-perpetuating system. Landowners receive secure income streams, while supply chain transparency is enhanced, for the benefit of investors.

The land use sector is ready for the green transition, but the involved players can’t do it in isolation.

When building and scaling blended finance models, we can move towards a robust ecosystem capable of delivering on the ever-growing climate finance demand.

“Up to $15 billion USD in concessional funds could generate over $280 billion USD in private investment.”

Pablo Fernandez

CEO, EcoSecurities