This year’s COP29 is expected to deliver on climate finance.

Nearly all topics discussed at Baku will require significant financing if they’re to achieve targets under the Paris Agreement.

The New Collective Quantified Goal (NCQG), the successor to the 2009 target of generating $100 billion USD annually for climate action by 2025, will be the protagonist of this year’s agenda.

Negotiators still have a long road ahead before there is an actionable and mature framework in place, but the role of Article 6 in mobilising climate finance will be key.

IETA concluded in its report, ‘Modelling the Economic Benefits of Article 6’, that transactions under a fully implemented, global Article 6 carbon market could surpass $100 billion USD per year by 2030. This would save governments nearly $300 billion USD in mitigation costs compared to seeking Nationally Determined Contribution (NDC) targets independently of a carbon market.

To capitalise on this potential, the groundwork needs to be laid in host countries, ensuring they can take ownership and effectively participate in Article 6 mechanisms. This is particularly true for the Global South, where countries have untapped decarbonisation potential across energy efficiency, heavy to abate industries and low-carbon fuels, and in developing cleaner energy sources and nature-based industries.

At the same time, many countries also lack proper infrastructure and a full understanding of the requirements of operationalising Article 6.

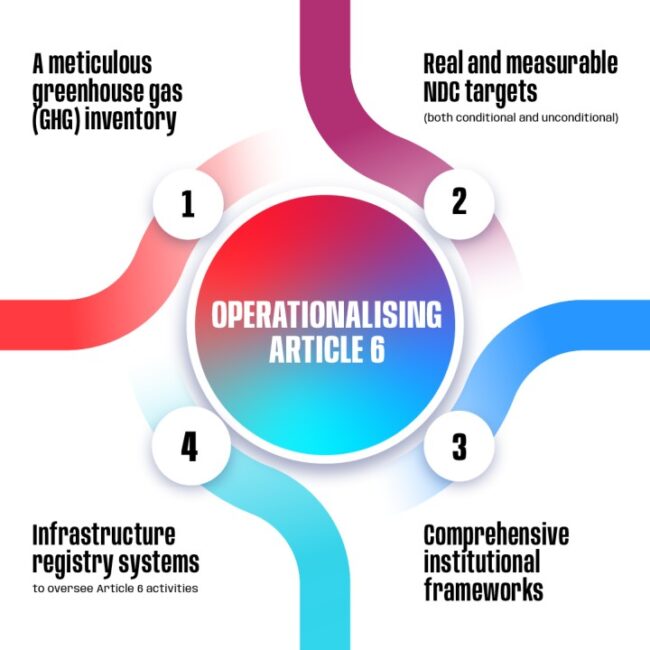

Host countries must look towards implementing a set of stringent criteria, including:

● A meticulous greenhouse gas (GHG) inventory

● Real and measurable NDC targets, both conditional and unconditional

● Comprehensive institutional frameworks

● Infrastructure registry systems to oversee Article 6 activities

Such process can be seen in the Philippines, where the government’s willingness to build its readiness for Article 6 is clear. The country has already nominated its focal point under Paris Agreement’s Article 6.4 Mechanism and has been taking steps to develop an overall policy framework that will support its efforts towards readiness for international cooperation under Article 6. Its progress, which must be applauded, shows how preparing for Article 6 must be done with country ownership but also recognizing the urgency of climate emergency, which requires fast implementation of incentives and tools to unlock the flow of climate finance under Article 6 mechanism.

Of course, even when countries become Article 6 ready, there are complexities that come with scaling the market. Questions remain over how credits are authorised and how to ensure transparency. However, negotiations at Bonn showed that the international community is addressing these issues, creating common understandings around key Article 6 issues, leading to a cautious yet optimistic energy ahead of Baku.

Ultimately, we should not lose sight of why carbon markets were created – to scale climate finance. Therefore, the economic potential outlined in IETA’s report should not be ignored. The statistics show just how significant these markets could be in directing climate finance to where it’s needed most.

Pedro Carvalho, Head of Policy and Markets, EcoSecurities